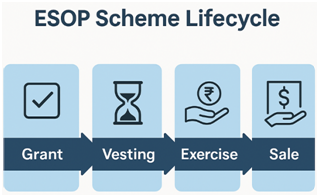

This article explains how ESOPs work for unlisted companies in India, the regulatory framework governing them, and the key practical considerations in designing and implementing an effective scheme.

1. Legal Framework

Unlisted companies in India can issue ESOPs under Section 62 of the Companies Act, 2013 read with Rule 12 of the Companies (Share Capital and Debentures) Rules, 2014.

An ESOP scheme must be approved by:

- The Board of Directors, and

- Shareholders by Special Resolution at a general meeting.

Key governance points include:

- Valuation: The Fair Market Value (FMV) of shares must be certified by an IBBI-registered valuer. This valuation typically follows the Discounted Cash Flow (DCF) method.

- Vesting: Options can vest only after a minimum of one year from the date of grant, with vesting schedules often spread over 3–4 years.

- Eligibility: Permanent employees and directors (excluding independent directors) of the company, its subsidiaries or holding company can be covered.

- Restrictions: Promoters and directors holding more than 10% of equity are generally not eligible. Certain exceptions apply for startups.

- Non-transferability: Options cannot be sold, pledged, or transferred.

- Approvals for variations: Any change in terms of the ESOP scheme requires shareholder approval again, provided it is not detrimental to option holders.

2. Valuation and Accounting

ESOPs involve multiple valuation exercise:

- Fair Market Value of Shares (by a IBBI registered valuer) – this helps to determine the exercise price.

- Valuation of Option through an independent valuer – usually done as per Black-Scholes model, this valuation helps to arrive at the charge that will be made to the P&L. The fair value are to be written off over the life of the options, in line with the Accounting Standards, as an employee compensation expense. Corresponding amount is credited to the reserves.

- The Fair Market Value of Shares is again required to be computed – this time, through a SEBI-registered Category 1 merchant banker – this helps to determine the perquisite value for the purpose of income tax of the employee.

3. Taxation for Employees

Employees are taxed in two stages:

- At Exercise: The difference between FMV (as on exercise date) and exercise price is treated as perquisite and taxed as salary income. Applicable tax deduction at source will apply.

- At Sale: When the employee sells the shares, the gain is taxed as capital gains. There could be other modes of providing liquidity that may have different tax impact.

4. Key Design Features to be considered

- Dilution: percentage of equity to be offered through this route.

- Employee eligibility: Considering the objectives that the shareholders wish to achieve, the eligible category of employees.

- Vesting Schedule: Typically 3–4 years (e.g., 25% each year or 30-30-40), with a minimum one-year cliff.

- Exercise Period: Can range from 5–10 years, or shorter as decided by the company.

- Exit / liquidity routes for Employees: Since unlisted companies’ shares are not tradeable, it is essential to consider potential liquidity strategy for employees at the time of scheme design.Company buyback, Third-party sale or Offer for sale during IPO are some of the potential modes of enabling employees monetise their shareholding.

- Employee rights: Option holders do not have dividend or voting rights until shares are actually issued.

- IPO: If a company is planning for an IPO down the road, it will be important to understand the potential interplay of ESOP and IPO to avoidunpleasant surprises. Post IPO, the ESOP scheme must become compliant with SEBI regulations for ESOPs for listed companies.

5. Operational aspects

- Once designed, implementation of ESOP is mostly operational, though involves quite a bit of administration and paperwork working through a timetable. It is essential to have a proper plan that runs like a clockwork, meeting relevant deadlines and compliances.

- Automation solutions could also be considered depending on extent of work involved and resources.

6. Why ESOPs Matter

For private and founder-led organisations, ESOPs serve as a strategic retention and alignment tool — linking compensation directly with long-term business value. A well-structured ESOP builds trust, transparency, and shared ownership while retaining flexibility and control for the promoters.

This article written as of 24 November 2025.

About Compliense Advisors

Compliense Advisors is a Compliance Advisory firm. We advise on compliance, regulatory matters and corporate governance matters. Our subject matter expertise includes Privacy (DPDP), AML (PMLA) and Anti-Financial Crime; and Insurance and Mutual Fund regulations, as also a range of Corporate Governance matters, including ESOP design, documentation, and implementation.

Write to us on info@compliense.com for discussing your matter. Visit our website for more such knowledge resources. If you liked this update, sign up for new articles and updates.

Note: The above article is for general informational purposes only and does not constitute professional or legal advice. Please seek specific advice for your situation. We do not warrant on the accuracy or completeness of the subject matter discussed above and disclaim all liability for any losses or damages caused to or incurred by any person.